IRS Form 1099-K

What Is Form 1099-K?

The forms in the Internal Revenue Services (IRS's) 1099 series help taxpayers report monies received from a variety of sources that aren't a paycheck. Form 1099-K, "Payment Card and Third Party Network Transactions," is the IRS form that taxpayers receive to report certain payment transactions. If you're self-employed or an independent contractor, you report 1099-K income on Schedule C of your federal Form 1040 tax return.

Who Needs Form 1099-K?

You should receive Form 1099-K by Jan. 31 if, in the prior calendar year, you received payments from payment card transactions (including debit cards, credit cards, stored-value cards, or PayPal) and/or in settlement of third-party payment network transactions involving gross payments of more than $20,000 and more than 200 transactions. Typically, large-volume online sellers file taxes with a 1099-K. You receive a 1099-K from each payment settlement entity (PSE) from which you received income for reportable payment transactions in the previous year. That means a payment card transaction or a third-party network transaction: 1. "Payment card transaction" means any transaction in which a payment card, or any account number or other identifying data associated with a payment card, is accepted as payment. 2. "Third-party network transaction" means any transaction settled through a third-party payment network—but only after the total exceeds the above thresholds. The gross amount of a reportable payment doesn’t include adjustments for credits, cash equivalents, discount amounts, fees, refunded amounts, or any other amounts.

Why Is Form 1099-K Important?

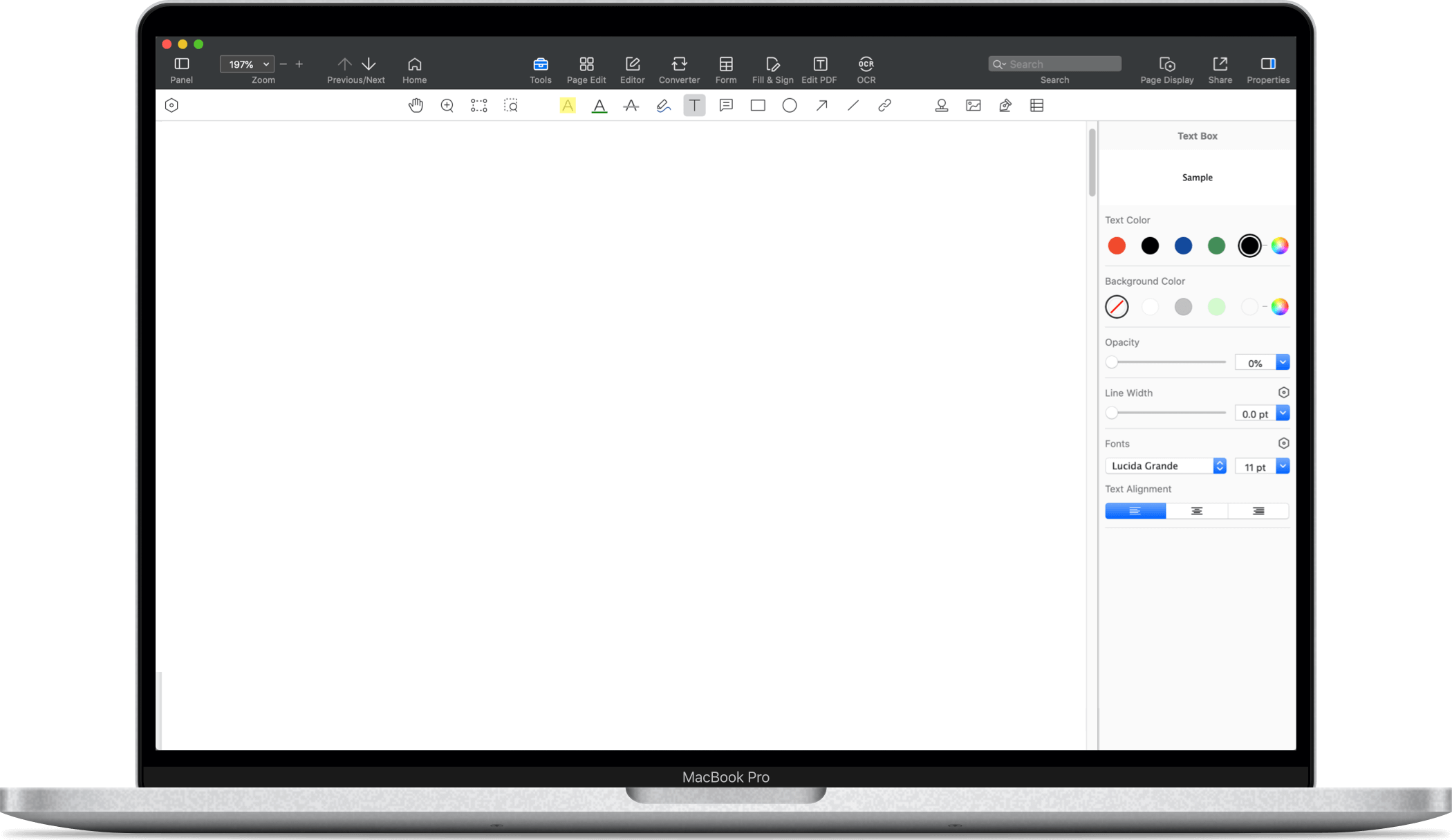

The 1099-K is an important form when you report business income on your tax return. It contains a lot of information, so verify that everything on the form is correct. If you don't, you could run into trouble. If you have questions, contact your payment settlement entity and/or work with a tax preparer or expert. After downloading the free Form 1099-K template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "free download" to download the app.

PDF Reader Pro

PDF Reader Pro

PDF Master

PDF Master